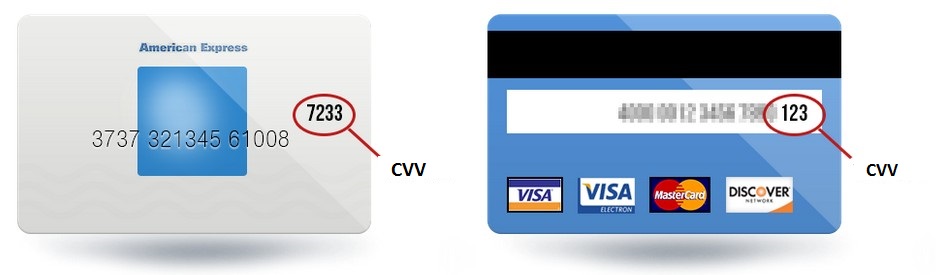

CVV

CVV, or Card Verification Value, is the group of three or four digits located on the back of the card. The name of this code varies between credit card companies, as it may also be referred to as card verification code or CVC (Card Verification Code), card security code, or personal security code.

The codes have different names:

- "CID" or "Card Identification Number" - Discover

- "CID" or "Card Unique Code" - American Express

- "CSC" or "Card Security Code" - Debit Card

- "CVC2" or "Card Validation Code" - MasterCard

- "CVE" or "Elo Verification Code" - Elo - Brazil

- "CVN2" or "Card Validation Number 2" - UnionPay

- "CVV2" or "Card Verification Value 2" - Visa

It is important to highlight that no provider can store this value permanently in their systems.

What is a dynamic CVV?

Currently, there are banking entities that issue credit and debit cards that do not have the CVV code printed on them. This is known as cards with dynamic CVV. This type of verification code changes periodically, so to obtain it, the cardholder must access their bank's digital banking service. Therefore, for each payment made, a new CVV is generated. This innovative validation code takes online shopping security a step further.

How to use the CVV?

Its primary use is in e-commerce channels over the Internet.

When making a purchase where the customer is present (CIT), in many processes, in addition to the card number and expiration date, the CVV is requested as an additional security measure. This small measure can add more integrity to the transaction.

However, there are user experience studies that conclude that asking for more data from a user can create friction and even affect conversion rates.

With the application of PSD2, all CIT transactions must now be authenticated with at least two factors, which may reduce the relevance of the CVV.

When the card is stored in the gateway through a tokenization process, the CVV will never be stored.