Call Center IVR

Our IVR switchboard technology uses open SIP and RTP standards. For PCI DSS security, both protocols are reinforced: SIP with TLSv1.2 and RTP with Secure RTP (SRTP).

Regarding integration, we establish an IPSec tunnel for point-to-point communication, enabling traffic prioritization and security. This optimizes the connection by avoiding NAT packet modification.

We set up a SIP Trunk to connect both systems, allowing the switchboards to "recognize" each other and exchange communications. For business operations, such as:

- Sale

- Sale with tokenization

- Tokenization with a zero-value transaction

We use SIP headers to indicate the type of operation, order number, token ID, amount, and other relevant data. Additional SIP headers enable call redirection to our IVR, which then runs a call management plan based on voice prompts. This redirection is handled by the Merchant’s Call Center CTI application.

Data entry can be done by phone keypad or voice input, depending on the user experience and target audience. Once data is collected, we process the transaction and return the result through one or both of these mechanisms:

- HTTP POST callback to a URL specified in the SIP header

- Returning the call to your call center with the operation result in SIP headers

Finally, it is essential to decide how the call should end: within our IVR, sent to a queue in your call center, or back to the agent who forwarded the call.

Integration Models

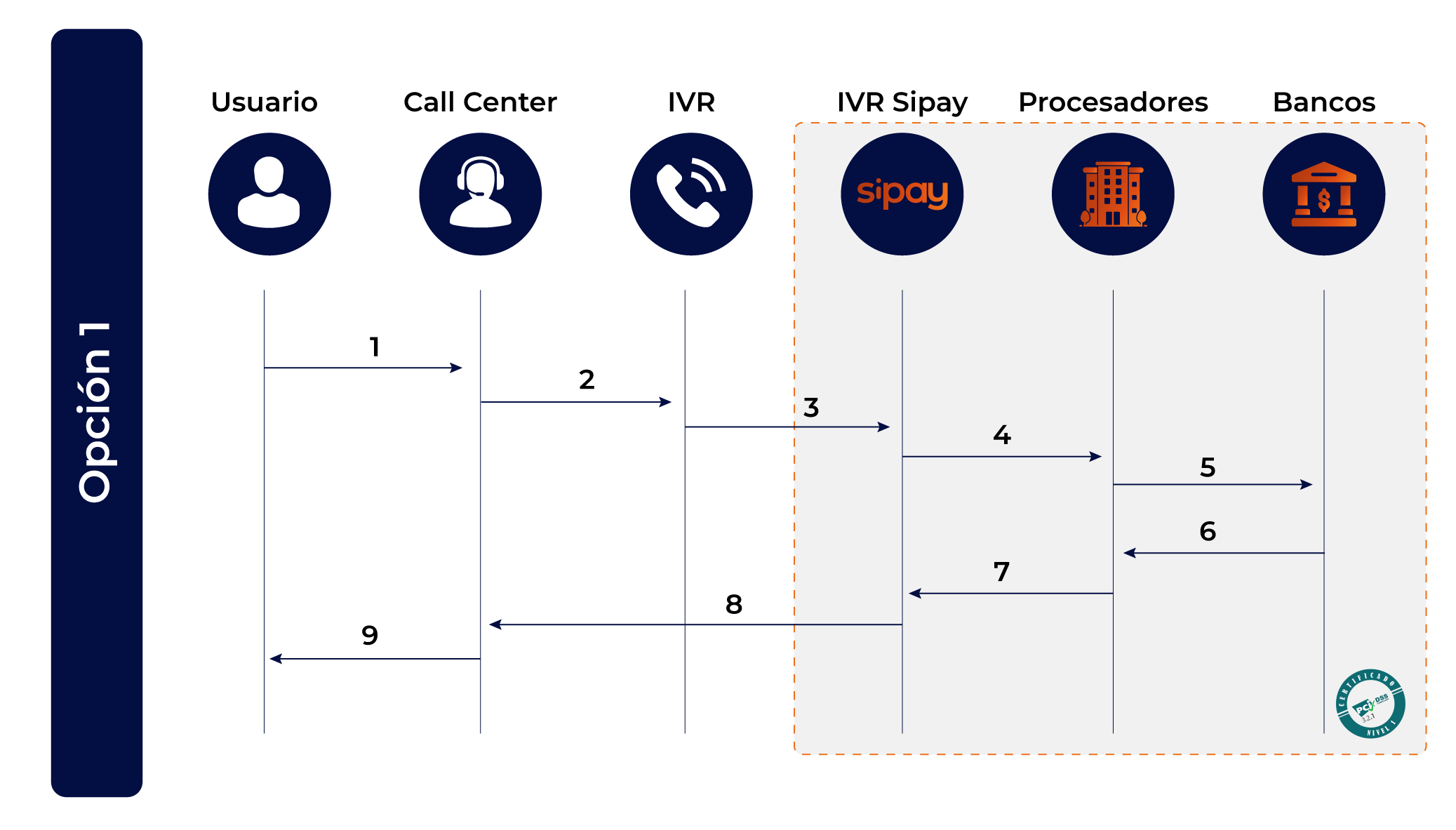

Model 1: The Merchant Already Has an IVR

The consumer calls and is served by the call center, which transfers the call to the Merchant's IVR. At the same time, the call is transferred to Sipay IVR, which securely captures card data, processes the transaction, and returns the processed transaction.

Steps:

- The consumer calls the Call Center, interested in making a purchase.

- The call center records the consumer's details in the Merchant’s IVR system.

- The Merchant’s IVR transfers the call to the Sipay IVR solution.

- Sipay IVR securely captures the consumer’s card data.

- The data is captured and processed by processors.

- Banks send the response from the processing entity.

- Processors generate and send the transaction confirmation to the Sipay IVR system.

- The Sipay IVR system sends the operation result to the call center.

- The Call Center sends the response to the consumer.

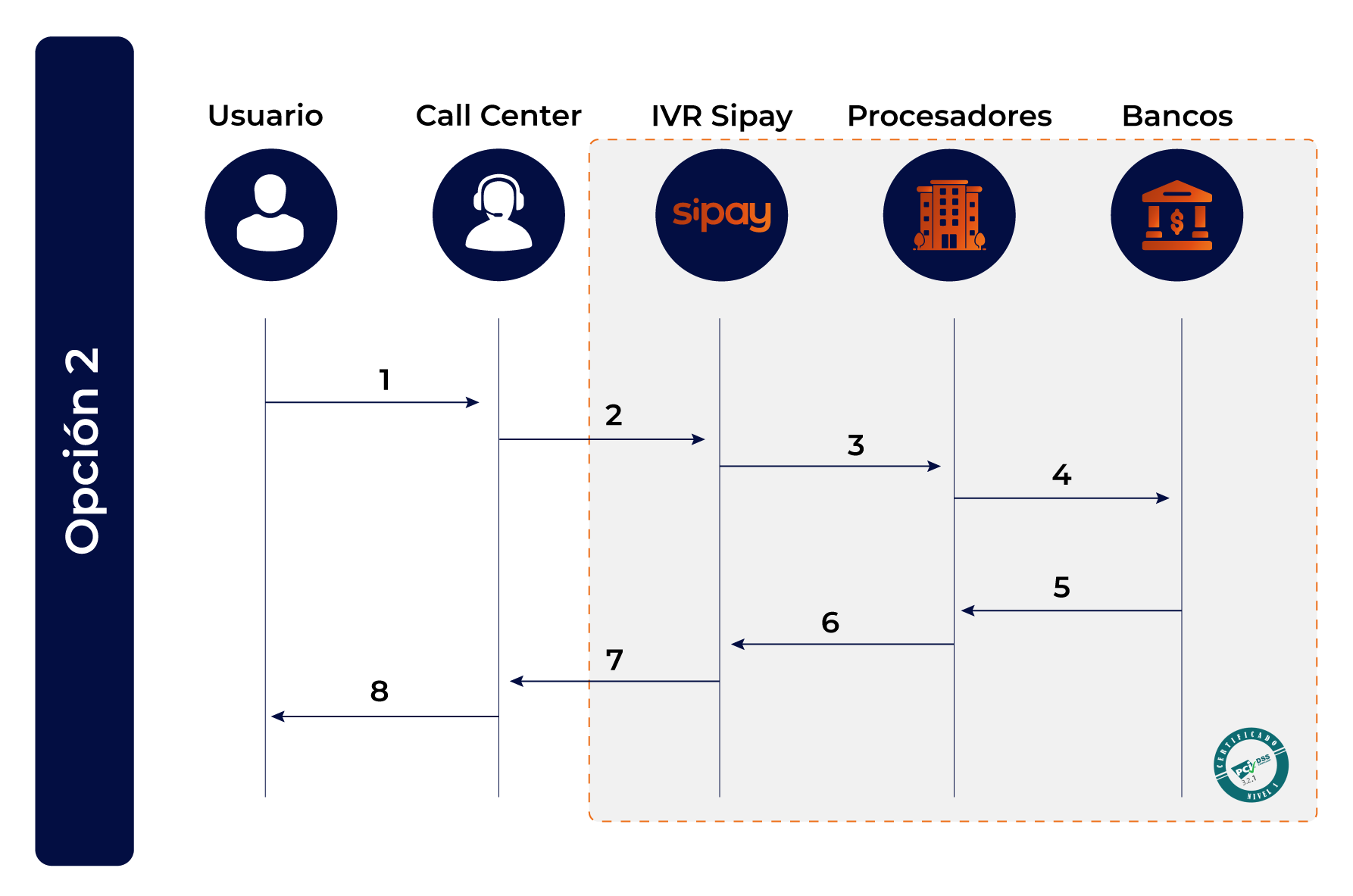

Model 2: The Merchant Has a Call Center with Agents

The consumer calls and is served by the call center, which transfers the call to Sipay IVR, securely capturing card data, processing the transaction, and returning the result.

Steps:

- The consumer calls the Call Center, interested in making a purchase.

- The call center records the customer’s details (in an unsecured manner) in the Merchant’s IVR system and transfers the call to Sipay IVR.

- Sipay IVR securely captures the consumer’s card data.

- The data is captured and processed by processors.

- Banks send the response from the processing entity.

- Processors generate and send the transaction confirmation to the Sipay IVR system.

- The Sipay IVR system sends the operation result to the call center.

- The Call Center sends the response to the consumer.